REFERRAL PERKS®

For a limited time, earn $200* for you and your friend for every successful referral.

For a limited time, earn $200* for you and your friend for every successful referral.

Learn how an FHSA helps you save for your first home faster.

Learn which savings option is the best for your financial goals.

Explore this step-by-step complete guide to starting a business in British Columbia.

We’ve rounded up 10 of the most common scams — along with ways to identify and outsmart them.

We use cookies to personalize your browsing experience, save your preferences and analyze our traffic to improve features. By using our website you agree to our Cookie Policy.

Buying your first home might be the largest purchase of your life and it's important to have a great plan in place. As a first-time home buyer there are various tax-free savings plans and accounts available from the federal government to help reach your home ownership goal sooner. Speak to an advisor about accounts and plans that can help you on your home buying journey.

| FIRST HOME SAVINGS ACCOUNT (FHSA) Save for a down payment tax-free for up to 15 years — benefit from tax-free investment earnings and tax-deductible contributions. LEARN MORE > |

| HOME BUYERS PLAN (HBP) Take out up to $60,000 from your RRSP tax-free for the purchase of a home. LEARN MORE > |

| TAX-FREE SAVINGS ACCOUNT (TFSA) Grow your savings faster with tax-free income and capital gains earned in a TFSA. Your savings can be withdrawn at any time and always tax-free. LEARN MORE > |

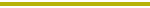

You can benefit by combining the First Home Savings Account (FHSA) and the Home Buyers Plan (HBP) to maximize your tax-free savings potential. Withdraw up to $40,000 from the FHSA and $60,000 from the HBP for a total of $100,000.

Are you a couple and buying a home together? Combine both of your FHSA and HBP to build a larger down payment.

Our advisors are happy to guide you and answer any questions or concerns you may have.

Great job! At this stage you’re confident about your savings plan and your home search begins. Now’s the time to understand your the next steps to obtaining a mortgage and learn about term options, rates, required documents, and even lock in a great rate for 120 days by applying for a mortgage.

You’re ready to put in an offer and scoop up the home of your dreams. Consider closing costs, inspections, and appraisals.

Learn more

*The fixed mortgage rate is only available to members with greater than 20% down payment, purchasing a residential, owner occupied property valued at under $1,000,000, and who meet other conditions. A premium may be applied to the rates for all other mortgages. Please visit a branch or call us at 1-888-597-1083 for further details.

**This insured mortgage rate is only available to members with less than 20% down payment, purchasing a residential property valued at under $1,500,000, who are eligible for and purchase mortgage default insurance and meet other conditions. Mortgage default loan insurance is required by lenders when homebuyers make a down payment of less than 20% of the purchase price. Mortgage loan insurance helps protect lenders against mortgage default, and enables consumers to purchase homes with a minimum down payment. The premium is calculated based on a percentage of the amount borrowed. Your premium can be paid upfront in a single lump sum payment, or it can be added to the total balance of your mortgage and included in your monthly payments – in this case, interest will apply to the premium as well. The minimum down payment requirement for mortgage default insurance depends on the purchase price of the home. For a purchase price of $500,000 or less, the minimum down payment is 5%. When the purchase price is above $500,000, the minimum down payment is 5% for the first $500,000 and 10% for the remaining portion. Mortgage default insurance is available only for properties with a purchase price or as-improved/renovated value below $1,500,000.

†Mortgage rates are subject to changes without notice and are available O.A.C. Fixed mortgage rates are compounded semi-annually; variable mortgage rates are compounded monthly. Mortgage rates are based on a 25 year amortization. Terms and conditions may apply. Mortgage funds must be advanced within 12 days of the application date. These rates are discounted and cannot be combined with any other rate discounts, promotions or offers. Additional fees may apply. For specific Annual Percentage Rate (APR) rates, please contact us.

The first step is to save for a down payment. It's best to understand what is involved to ensure you are well prepared for all the expenses.

This will be different for everyone. Some factors that play a role are income, your savings plan, your time horizon, the purchase price of your home, if you're planning on getting an insured or uninsured mortgage. Your advisor will work with you to set a plan in place to maximize your savings potential to get you to your goals faster. The government provides some great savings programs that can assist with this.

Other than the cost of your home, you'll need to consider other closing costs like the property transfer tax, a home inspection, property appraisals, legal fees and more. Learn more here.

If you need to borrow money to buy a home then, yes, credit worthiness is a key requirement to obtaining a mortgage. A good credit score will also help you getting the lowest rate.

You can lock in a mortgage rate up to 120 days in advance. The earlier you do this the better chance you have of protecting yourself in case of rising rates and it gives you more time to plan for other aspects of your home buying journey.

It depends on each person’s individual needs. You can select a fixed or variable rate and they can be open or closed. Your advisor will help you determine which rate type best fits your goals.

If you qualify under the Home Buyers Plan then you can withdraw up to $60,000 from your RRSP for the purposes of purchasing your first home.

The Home Buyers’ Plan (HBP) allows you to withdraw up to $60,000 from your RRSP for the purposes of buying your first home but withdrawals must be repaid within 15 years. The FHSA (First Home Savings Account) is an account specifically designed to help you save tax-free for the purposes of buying your first home and allows up to a $40,000 lifetime contribution limit. They can be combined as long as its for the same qualifying home.

Mutual funds and other securities are offered through Aviso Wealth, a division of Aviso Financial Inc.

We acknowledge that we have the privilege of doing business on the traditional and unceded territory of First Nations communities.

© First West Credit Union. All rights reserved.

Proudly Canadian