REFERRAL PERKS®

Earn $100* for you and your friend for every successful referral.

Learn how an FHSA helps you save for a mortgage faster.

Learn which savings option is the best for your financial goals.

Explore this step-by-step complete guide to starting a business in British Columbia.

We’ve rounded up 10 of the most common scams — along with ways to identify and outsmart them.

We use cookies to personalize your browsing experience, save your preferences and analyze our traffic to improve features. By using our website you agree to our Cookie Policy.

You may have heard people talking about term deposits in passing, and maybe you’ve wondered if they are right for you.

Also known as a Guaranteed Investment Certificate—or GIC for short—a term deposit is a low-risk investment that pays a guaranteed rate of return over terms ranging from 30 days all the way up to 5 years.

They’re different from other saving tools because you invest money for set terms without being able to contribute to them before they mature. Whether or not you should invest in a term deposit depends on many different factors. This includes:

Term deposits are specialized saving solutions that depend so much on timing that, you might have also wondered, “When should I buy a term deposit?” The answer to that question comes down to maximizing your return.

Let’s explore when to consider, and what could impact the earnings you get back from, a term deposit.

There are so many expenses in life you can’t anticipate. But there are a few you can; life milestones, like your child’s wedding or their post-secondary pursuits.

When it comes to budgeting for those big expenses like weddings, mortgages, or dream getaways, a term deposit can be a very useful tool to get there.

If you have savings already that you are intending on setting aside, you could earn extra on top of it by locking it in a term deposit with a great interest rate. Then, when the term matures and it’s ready to spend, that fund can be topped off with the earnings from interest.

We often see inflation as an unwanted visitor. But what if you could make inflation work for your budget instead of against it? One way to take advantage of inflation is to invest when rates are higher.

When interest rates rise, you may have a chance to lock in a better rate of return on a term deposit before they drop. Even in market conditions where inflation has peaked and trends downward, it’s worth looking into.

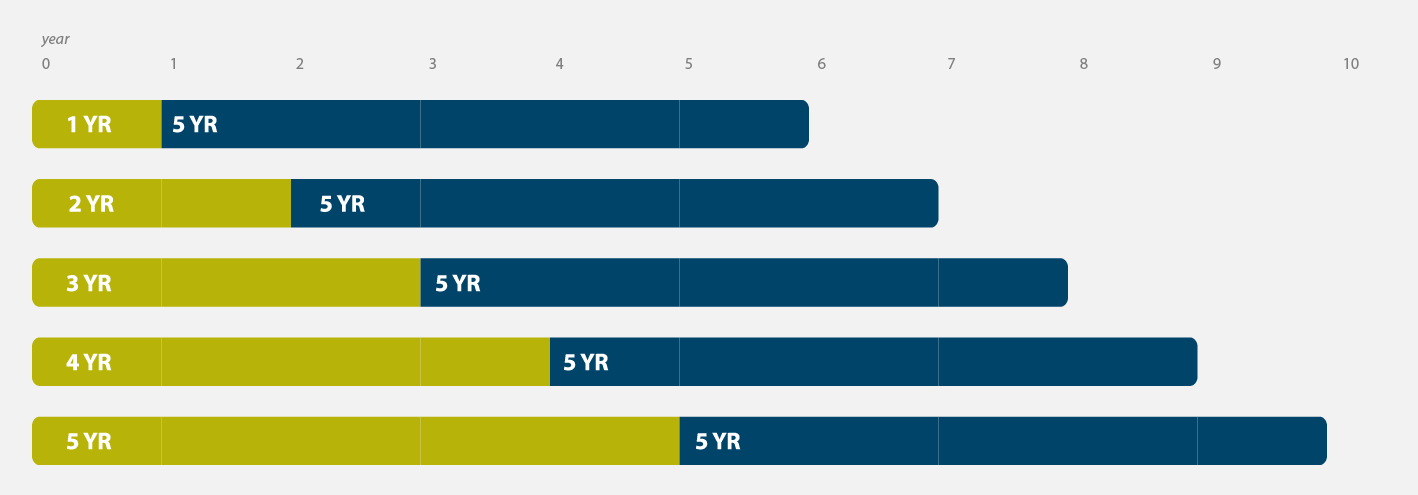

This is why laddering works so well; it can help you lock in your savings at inflated interest rates before they dip, while also giving you more access to your money than a single term deposit may offer. With laddering, instead of putting all your savings in a single term deposit, you split it into five equal parts. Then, each of those parts goes into its own investment, ranging from one to 5 years.

As a term deposit matures each year, you’ll get opportunities to invest it in another term deposit and keep up with inflated interest rates.

Being a more conservative investor doesn’t mean you can’t see your savings grow. It just means there are different options to explore that are more comfortable for you.

That’s where term deposits enter the picture. They’re virtually risk-free because they guarantee your investment back 100% of the time. And they’re more ideal if you’re looking at your investment options in a low-interest environment.

If you are newer to investing, and still getting comfortable with investments tied to the market, a market-linked GIC is a great option to think about. While you’re guaranteed your principle, the return is determined by market performance.

Think of it this way: Your earnings will always have a stable floor that they can’t go lower than, but they could have an even higher ceiling for earning potential than a standard term deposit.

It’s not a bad thing at all to have access to your savings. That's what rainy-day funds are there for: to cover unexpected day-to-day costs without having to borrow money, so it needs to be accessible. If you’re trying to save, but feel tempted to withdraw money often, a better option may be to keep your savings out of sight and out of mind.

A term deposit lets you stow your savings away for years at a time if you want. But it also allows you to access those savings sooner than a Registered Retirement Savings Plan (RRSP).

We talk a lot about saving for retirement, but what about saving in retirement? In your golden years, there are still opportunities to grow your wealth. They just look a bit different now that you have a fixed income.

Term deposits are much lower in risk and can offer a quicker return with just one upfront deposit. Even if you’re not quite retired yet, they allow you to take control of your financial future before retirement comes.

If this sounds right up your alley, a Tax-Free Savings Account (TFSA) may be a good option to explore. Any interest you earn from a term deposit in a TFSA isn’t taxed—which is crucial when you’re on a fixed income and looking for ways to minimize spending.

Need a sense of whether you should consider a term deposit right now? Talking to a financial advisor about your goals will help you see how they can support your journey.

Your advisor can offer personalized advice that will highlight what your next best action is. And, when you’re ready, you can talk to them about whether a term deposit is right for you.

You may still have questions about when you should consider a term deposit, and we’re happy to answer them. Book an appointment today.

Mutual funds and other securities are offered through Aviso Wealth, a division of Aviso Financial Inc. Unless otherwise stated, mutual funds, other securities and cash balances are not covered by the Canada Deposit Insurance Corporation or by any other government deposit insurer that insures deposits in credit unions.

We acknowledge that we have the privilege of doing business on the traditional and unceded territory of First Nations communities.

© First West Credit Union. All rights reserved.

Proudly Canadian