REFERRAL PERKS®

Earn $100* for you and your friend for every successful referral.

Learn how an FHSA helps you save for a mortgage faster.

Learn which savings option is the best for your financial goals.

Explore this step-by-step complete guide to starting a business in British Columbia.

We’ve rounded up 10 of the most common scams — along with ways to identify and outsmart them.

We use cookies to personalize your browsing experience, save your preferences and analyze our traffic to improve features. By using our website you agree to our Cookie Policy.

Perhaps you scored a seriously low interest rate a few years ago, but now the time to renew your mortgage is coming up. If you’re feeling uneasy about what this might mean for your financial situation, you’re not alone.

Almost all mortgages taken out in Canada before March 2022 are set to renew by the end of 2026. And with variable and fixed rates higher than they were a few years ago, many borrowers are wondering what their payments will look like this time around.

If your mortgage renewal is still a year out, there are steps you can take to adjust to your new mortgage, and make sure it doesn’t knock your budget off kilter. Adjusting your budget now will help you stay on track with saving goals like retirement, or other debt repayment plans.

Working a bigger payment into your budget can work if you take control now and test-drive your new rate. You wouldn’t buy a car without test-driving it, so why go into your next mortgage term without an idea of how it will impact your budget?

How do you do that? You strategically budget as if you are paying for that increase before you sign on for a term. This way, you are training yourself to budget and prepare for that rate without making a commitment.

Well, just how do you prepare for a mortgage rate increase? You start by reviewing your overall budget, as well as using a mortgage calculator to see how the two fit together.

If your mortgage renewal is next year, it’s time to look at your financial ‘big picture’ with the help of your advisor. Regularly reviewing your finances is part of any healthy financial plan and is a great opportunity to make sure you’re heading into your renewal with the best possible game plan.

![]()

Review how much you spend on each, and assess if you should scale it back:

If you don’t have buffer room in your budget to put any extra funds to your mortgage already, you’ll have time before committing to a new mortgage term to make changes.

The extra amount you’ll have to contribute to your mortgage payment each month will need to come from another source by:

Crunching the numbers on a new mortgage rate at renewal![]()

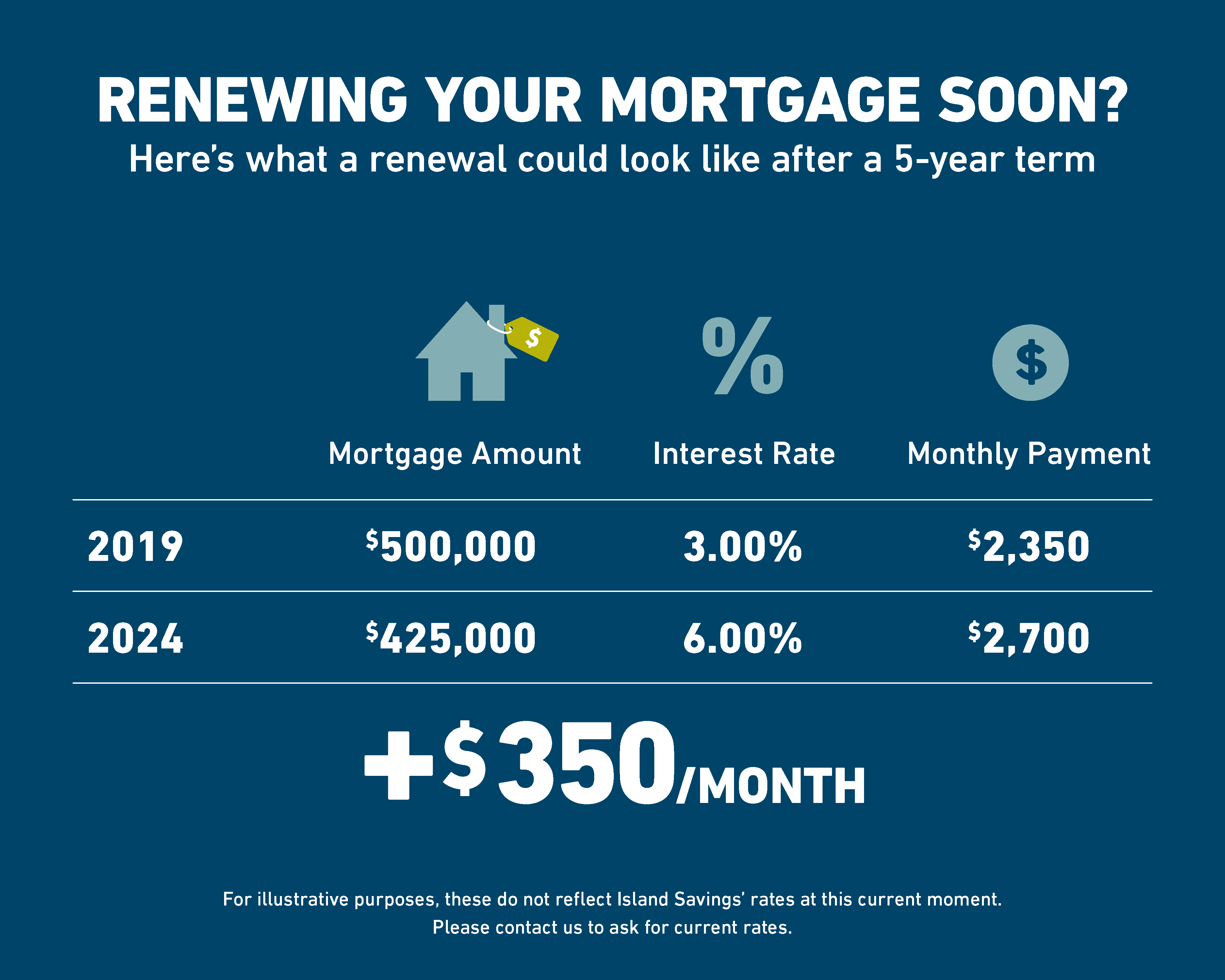

Let’s say that for the past few years, Joe has been paying a fixed rate of 3% on his $500,000 mortgage in Duncan, with a 25-year amortization.

Joe’s mortgage payment is just over $2,350 each month. As he approaches renewal, it’s time to meet with a mortgage advisor to explore his best rate options.

In this example, consider what a five-year fixed rate of 6% might mean for Joe’s monthly payments, with a remaining mortgage balance of around $425,000.

Even though Joe has paid down his mortgage over the last five years, the higher interest rate would push his monthly mortgage payment to over $2,700 – more than $350 per month higher than it has been over the last 5 years, or some $4,000 per year.

At this point, you will have a better idea of how much you can comfortably set aside each month and where this amount will come from. Now, there are low-risk strategies you can use to be proactive, avoid the sticker shock of your mortgage renewal, and even get yourself ahead in the process!

About 2.2 million Canadians are renewing their mortgages between 2024 and 2025.![]()

Rising interest rates have already increased payments for variable rate mortgage holders, but homeowners who secured fixed-rate mortgages at historic lows could see a 30 to 40% rise in payments at renewal.

Taking the example above, where your mortgage payment may increase by as much as $350 a month where you take on a five-year fixed-rate mortgage of 6%. Saving a lump sum each month leading up to renewal can provide a big boost to your bottom line.

Let’s say you’re 180 days (about 6 months) out from your renewal period. If you’re able to set aside even $75 a week in your no-fee high-interest savings account (especially a savings account with a bonus offer for new deposits), you’ll accumulate as much as $1,800 by renewal time. And that’s not even including interest.

The advantages of saving up a lump sum ahead of renewal are:

Don’t forget the stress test![]()

If you’re renewing with a new lender, you’ll not only have to afford your new mortgage payment, but you’ll have to pass the mortgage stress test. This test ensures you’ll be able to afford payments that are 2% higher than the rate you negotiate.

For example, if you are quoted a new mortgage rate of 5.3% with a new lender, you’ll also have to qualify at a rate of 7.3%, just to be on the safe side, should rates go up even further.

If you choose to renew with your existing lender, the stress test doesn’t apply.

Once you’ve experienced what your projected rate is like for the rest of your budget, you will have a few different options to explore:

Deciding to renew early will mean you have more time to potentially take advantage of any special rates and offers that may be currently available or lock in a rate before they increase.

You can renew as early as 180 days without a penalty, and we will guarantee your rate for up to 90 days.

Renewal time means you get to call the shots and decide on the mortgage terms that work best for your situation now.

You may decide that you want to pay on a different schedule or opt for different payment amounts. The choice is yours to make, with an advisor to guide you.

Getting used to your new budget may reveal to you that you will need to refinance your mortgage, but it’s better to know going into your renewal than to be blindsided by this.

If you’ve built up equity in your home, consolidating your loan payments may be another option. But to refinance, you will have to take another mortgage stress test, so be prepared.

If nothing else, we offer open terms that provide the flexibility of being able to make changes to the term without any penalties once you decide on a new term.

Rates for open terms are generally higher than locked-in rates.

Keep in mind, these are just a few of the options you can explore. An advisor can offer tailored recommendations throughout the renewal process, especially if this is your first mortgage renewal.

Get the financial advice you need

You don't have to figure out a plan on your own. Work with an advisor to find solutions that support your financial goals.

We acknowledge that we have the privilege of doing business on the traditional and unceded territory of First Nations communities.

© First West Credit Union. All rights reserved.

Proudly Canadian