REFERRAL PERKS®

Earn $100* for you and your friend for every successful referral.

Learn how an FHSA helps you save for a mortgage faster.

Learn which savings option is the best for your financial goals.

Explore this step-by-step complete guide to starting a business in British Columbia.

We use cookies to personalize your browsing experience, save your preferences and analyze our traffic to improve features. By using our website you agree to our Cookie Policy.

Financial solutions built around your goals, giving you the confidence to move forward.

Financial solutions built around your goals, giving you the confidence to move forward.

Island Savings, a proud division of First West Credit Union, combines the personalized approach of local banking with the resources to help you flourish.

Our accounts and services are built to support you whether you’re looking to do everyday banking, build a financial plan or excel in your business. Our advisors are ready to listen to your needs and help you bank your way.

Our accounts and services are built to support you whether you’re looking to do everyday banking, build a financial plan or excel in your business. Our advisors are ready to listen to your needs and help you bank your way.

![]() No monthly fee

No monthly fee

![]() No minimum balance required

No minimum balance required

![]() First 12 debit transactions free

First 12 debit transactions free

![]() $1.50* per transaction (13 through 18)

$1.50* per transaction (13 through 18)

![]() $9.00 maximum transaction fee per month

$9.00 maximum transaction fee per month

![]() Unlimited credit/deposit transactions

Unlimited credit/deposit transactions

The Tru Essentials Chequing Account gives casual spenders a $0 account while active spenders can rest easy knowing they won’t pay any more than $9.00 per month for unlimited debit transactions.

View all personal accounts >Tru Essentials chequing account includes 12 free debit transactions a month. Debit transactions 13 through 18 will be charged the below fees, up to a monthly maximum of $9.

It is free to move money between your First West Credit Union accounts using our online banking services and mobile apps.

No interest is paid on this account.

Members 19 years old and under will enjoy free banking until January 1 of the year the primary account holder turns 20. After that, standard account features and fees will apply.

A fee may also apply for any additional banking services you use. View Personal Service Fees to see our full list of account & service fees.

| Transaction | Fee |

| ATM withdrawal (via THE EXCHANGE® and ACCULINK® networks)† |

$1.50 |

| ATM deposit (via THE EXCHANGE® and ACCULINK® networks) |

Free |

| Cheque clearing | $1.50 |

| In-branch withdrawal | $1.50 |

| In-branch transfer out | $1.50 |

| In-branch utility bill payment / manual bill payment | $1.50 |

| In-branch deposit | Free |

| Electronic transfer between First West Credit Union accounts | Free |

| Electronic utility bill | $1.50 Island Savings credit card and CUMIS bill payments are free using online banking services and mobile apps |

| Cheque deposit via mobile app | Free |

| Interac e-Transfer® incoming (CAD currency only) | Free |

| Interac e-Transfer® Autodeposit (CAD currency only) | Free |

| Interac e-Transfer® outgoing (CAD currency only) | $1.50 |

| Interac e-Transfer® Request Money | $1.50 |

| Point of sale purchase | $1.50 |

| Point of sale return | Free |

| Me-to-Me transfer incoming | Free |

| Me-to-Me transfer outgoing | $1.50 |

| Pre-authorized debit (payment) | $1.50 Island Savings credit card and CUMIS bill payments are free using online banking services and mobile apps |

| Pre-authorized credit | Free |

Open an account online to become a member and get free access to expert advisors. Or book an appointment to open in branch.

Open an account online to become a member and get free access to expert advisors. Or book an appointment to open in branch.

Our diverse range of account options allows you to select the one that best suits your needs. Whether you manage a high-transaction business, want to save for a rainy day, or run an agricultural enterprise, we have an account tailored for you.

All business accounts must be opened in the branch and require an appointment. Our advisors will let you know what documents you will need for your account opening.

We'll help you build a picture of your current financial situation by understanding your goals and developing a plan to get you there. Whether your working towards managing debt, making the most of your investments, or reaching a savings goals, our advisors are here to help you succeed

Learn more about planning and advice >

Tailored advice

Focus on diversity

Ongoing education

Long term committment

You’ve worked hard to build your foundation, now it’s time to empower you to live life on your terms and pave a path to get you there. We can help.

We'd love to hear from you. Contact us - our advisors will be happy to answer your questions.

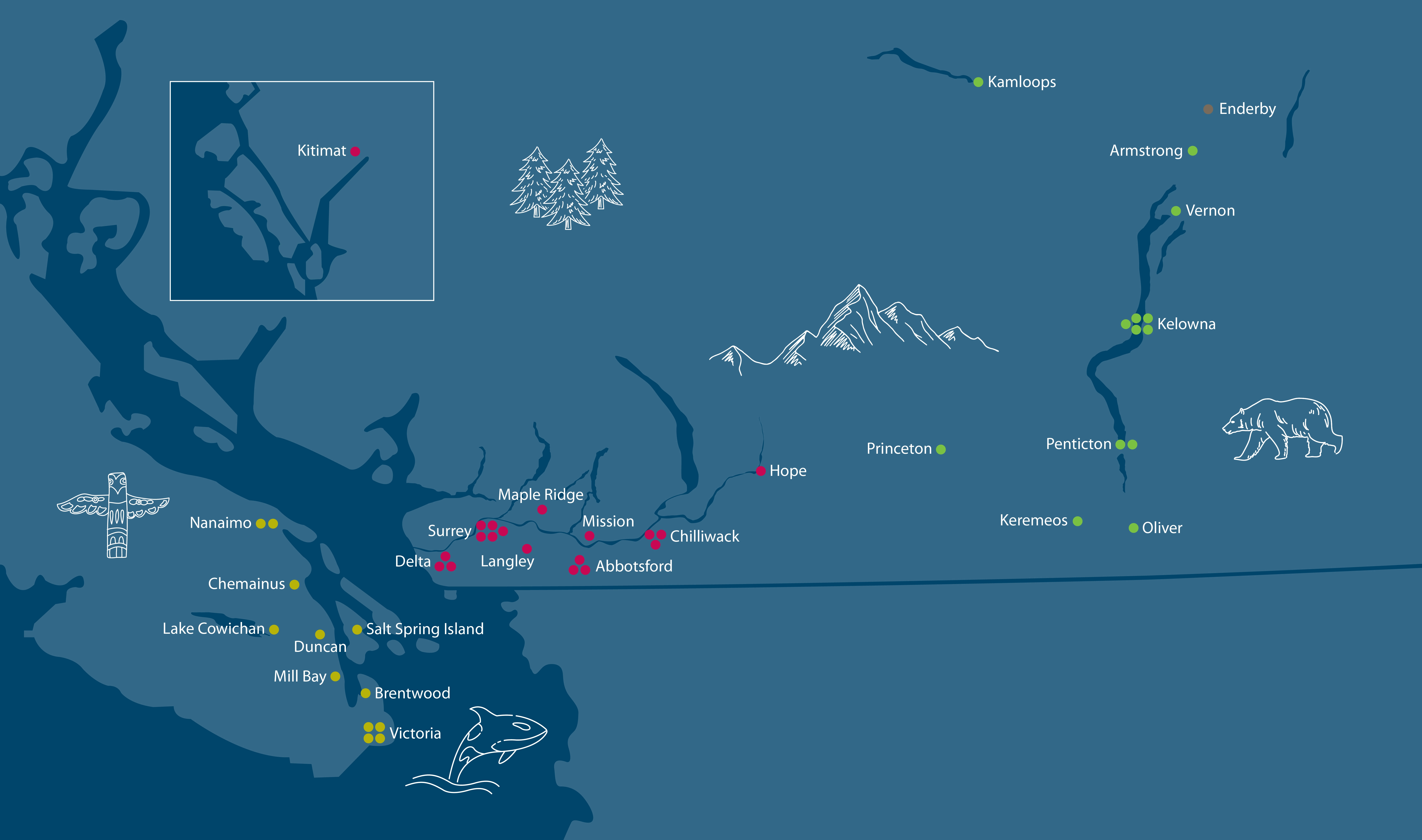

With our extensive network of branches across British Columbia, you can easily manage your daily banking needs or seek expert advice whenever you need it.

|

|

|

|

Computer |

App |

Phone |

Branch |

Our professionals combine expertise with genuine care to provide personalized solutions that help you achieve your financial goals.

Whether you're saving for today, building for the future or paying down debt, our advisors can help develop a customized plan to help you achieve your financial goals.

Whether you're saving for today, building for the future or paying down debt, our advisors can help develop a customized plan to help you achieve your financial goals.

When you join our credit union you are a member, not a customer, and that makes all the difference.

Our members are our owners and have an equal say in how our credit union operates, no matter their balance.

We acknowledge that we have the privilege of doing business on the traditional and unceded territory of First Nations communities.

© First West Credit Union. All rights reserved.